Insurtech Market Size, Share, Trends & Research Report, 2032 | UnivDatos

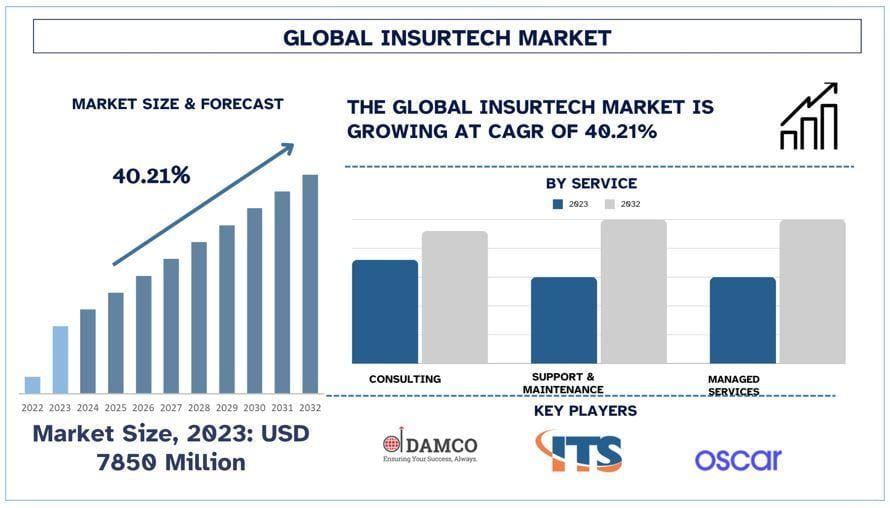

According to the UnivDatos analysis, growing demand for digitalization with Insurtech with increased efficiency will drive the growth scenario of Insurtech and as per their “Global Insurtech Market” report, the global market was valued at USD 7850 million in 2023, growing at a CAGR of 40.21% during the forecast period from 2024 - 2032 to reach USD million by 2032.

Insurtech refers to Insurance Technology services designed to offer digital services to insurance providers. These digital services offer real-time information to the insurance providers assisting in product customization, real-time information, money and savings, improving competitiveness, and making insurance services more sustainable. As the vast information is collected through various user patterns, a better-suited insurance product is offered further improving the expansion of insurance services.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/insurtech-market?popup=report-enquiry

Rising Demand for Digital Transformation in the Insurance Sector:

Insurance companies are increasingly adopting digital solutions in order to cater to a wide number of customers with their suited needs. These companies are relying on digital solutions for a user-friendly experience, streamlining operations, and enhancing the decision-making process.

In line with this many of the companies have extensively invested in integrating Insurtech solutions in recent years which has paved the growth path for the expansion of the market.

Additionally, to tap the growth opportunities present in the market many of the Insurtech companies have announced to undergo collaboration with other industry players which would help the technological expansion and services offering in the long-term. For instance, in 2023, a coalition of multiple insurance technology providers named Boost, Branch, Clearcover, Lemonade, and Root Insurance announced their plans to launch the Insurtech coalition. This coalition is aimed at re-imagining the service offering and managing the risks involved with efficiency.

These collaboration among the insurance companies to improve the adoption of digital technologies to enhance their customer delivery experience and offer new products to the customers would further grow in the coming years.

Considering the rampant expansion of insurance technology services and digital transformation the Global Insurtech market would experience growth during 2024-2032.

Rising Trend of Data Analytics in the Insurance Sector:

Implementation and usage of data analytics is one of the crucial developments for Insurtech services providers. Data analytics services offer improved speed, accuracy, and reliability of insurance forecasts. As predictive analytics offer various benefits such as risk assessment and underwriting, insurance pricing, insurance claim settlement, proactive prevention of claim cases, insurance product optimization, delivering a personalized experience, financial planning analysis, etc., insurance companies are moving towards integrating predictive analytics services to improve their optimal decision-making process.

With the rising need for improving the insurance companies working process and product offering along with the improvement of operational efficiency the demand for predictive analytics is further anticipated to rise during 2024-2032.

Click here to view the Report Description & TOC https://univdatos.com/reports/insurtech-market

Conclusion:

The Global Insurtech market is experiencing a transformative phase driven by technological advancements, sustainability in insurance sector operations, digitalization, market dynamics, and implementation of government policies. Stakeholders across the industry are embracing these trends to enhance operational efficiency, etc. As Insurtech through digitalization and providing predictive analytics, AI, chatbot, etc., for process improvement this has played a strategic role in improving insurance services, staying abreast of these trends and embracing innovation will be crucial for the Global Insurtech market.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Diffusion en direct

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Art

- Life

- Coding