Africa Mobile Money Market Growth, Segment, Analysis & Forecast Report, 2033 | UnivDatos

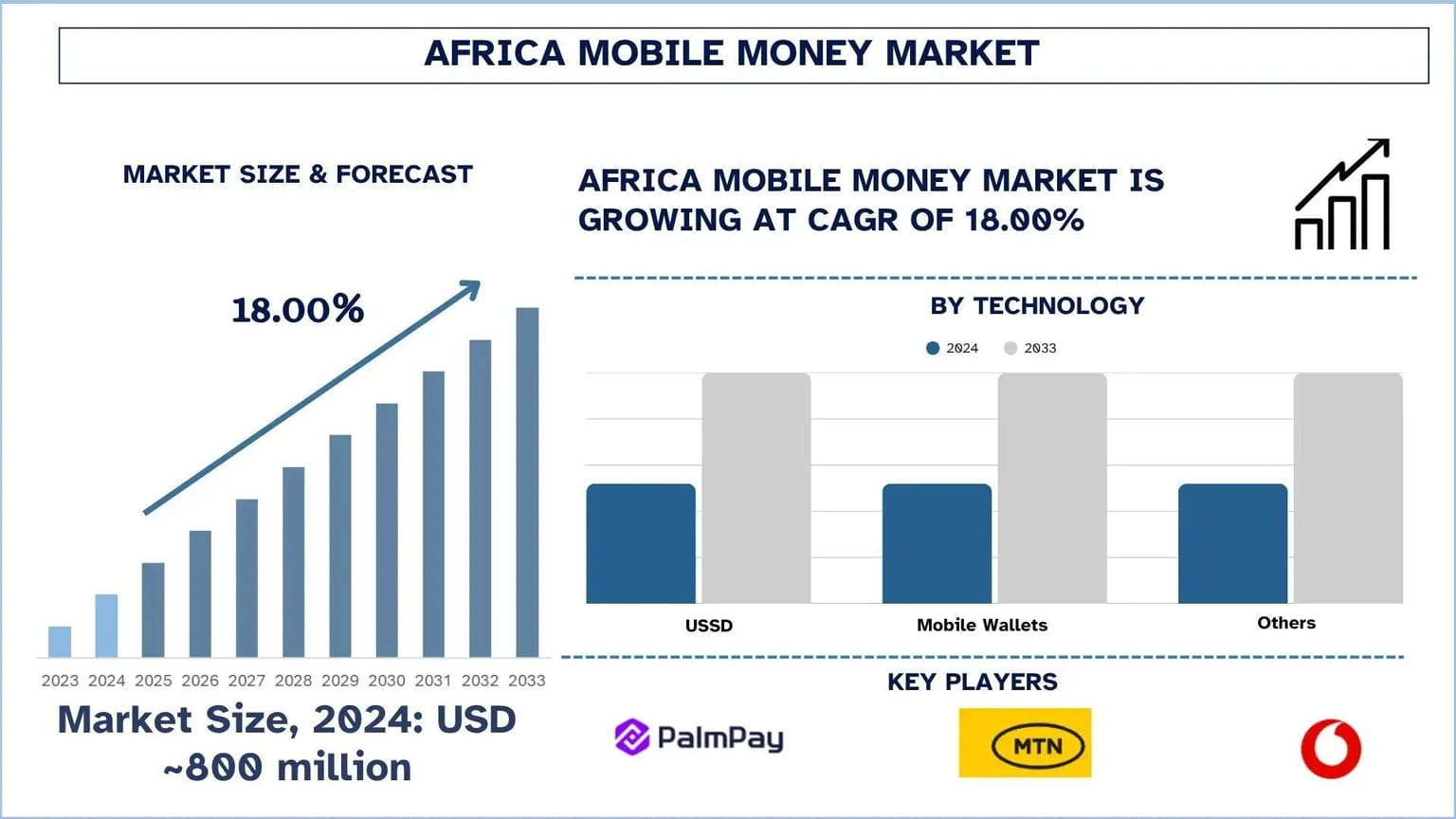

According to a new report by UnivDatos, the Africa Mobile Money Market is expected to reach USD million in 2033 by growing at a CAGR of 18.00% during the forecast period (2025-2033). The African mobile money market has been growing at a notable rate with the rising smartphone penetration, better mobile network, as well as the demand for available financial services. Mobile money services have not only been limited to simple transactions but have also been able to offer a multifarious array of services, including loans, savings, and insurance, and have revolutionized how people and business conduct their finances. The distinct opportunity in Africa is its huge, young, and mobile population that has accepted the concept of mobile wallets and digital payments as part of their lives. Moreover, the growth of mobile money services is further promoted through alliances of telecom operators, fintech players, and regulatory authorities, which creates an enabling innovation within the industry.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/africa-mobile-money-market?popup=report-enquiry

Segments that transform the industry

- Based on technology, the African mobile money market is segmented into USSD, Mobile wallet, and others. Among these, USSD has the highest market share owing to its wide access, particularly in regions where the internet is either limited or absent. USSD enables users to transact banking operations with basic feature phones, which is why the tool is critical to financial inclusion, especially in rural and underserved communities. It is an extremely important facilitator of mobile money services because of its simplicity, low-cost infrastructure, and its use without the need for an internet connection. Furthermore, mobile network operators and financial institutions have adopted USSD, which has further dominated the African market. USSD is one of the most important providers of financial services in the region as mobile penetration continues to rise.

According to the report, Cheaper smartphones + wider 4G/5G reach are pulling more people into mobile wallets, which has been identified as a key driver for market growth. Some of how this impact has been felt include:

- The growing prevalence of smartphones among the end-customers in Africa has led to the rise of mobile wallets. As more and more customers are using smartphones with application support for these mobile wallets, the dependence on physical cash as well as cheques has significantly reduced. Additionally, the widespread adoption of 4G and 5G networks supporting smartphones has also promoted financial inclusion. With improved network services across African countries, the adoption of mobile wallets is increasing in remote locations.

- Furthermore, this ease of quick and reliable transactions has brought a new era of digital transformation. Some of the recent updates that have been observed within the region are as follows:

- In 2023, according to the GSMA, the total number of smartphones with internet was 27% in sub-Saharan Africa. Apart from this, the overall mobile penetration was 27%. Furthermore, the smartphone penetration in Africa is anticipated to reach 88% by the year 2030, further promoting the digital services-based industries.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Technology, By Business Model, By Transaction Type, by Country

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Related Report:-

Brazil Digital Payments Market: Current Analysis and Forecast (2025-2033)

Southeast Asia E-Commerce Market: Current Analysis and Forecast (2025-2033)

Neo Banking Market: Current Analysis and Forecast (2023-2030)

MENA Fintech Market: Current Analysis and Forecast (2023-2030)

MasterCard Market: Current Analysis and Forecast (2022-2030)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Live Stream

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Art

- Life

- Coding