Meat Washing Machines Market Size to Reach USD 188.79 Million by 2032

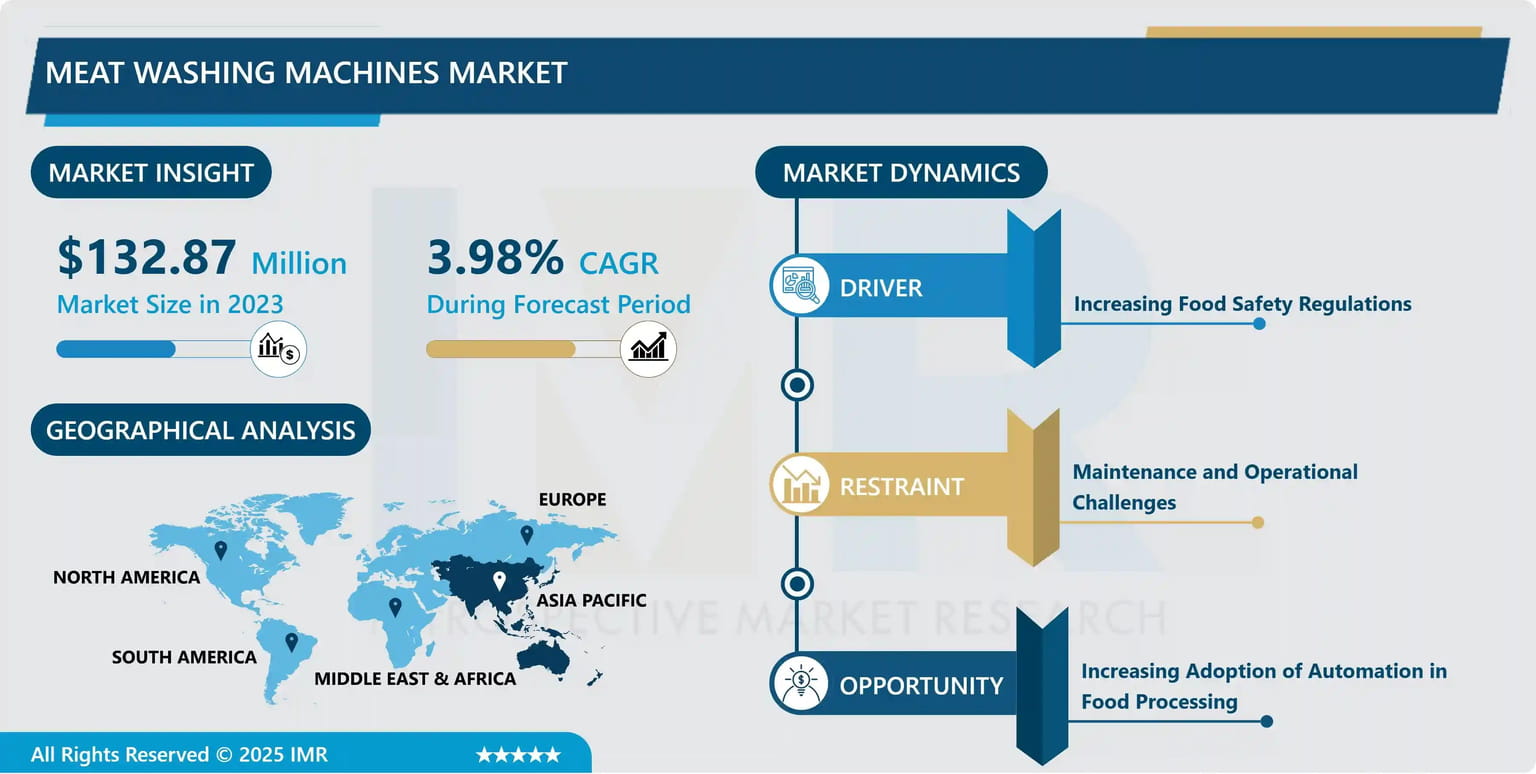

According to a new report published by Introspective Market Research, Meat Washing Machines Market by Product Type, Operation Mode, and End User, The Global Meat Washing Machines Market Size Was Valued at USD 132.87 Million in 2023 and is Projected to Reach USD 188.79 Million by 2032, Growing at a CAGR of 3.98%.

Introduction / Market Overview

The global Meat Washing Machines Market is witnessing steady growth as demand for efficient, hygienic, and automated meat processing equipment continues to rise. These machines play a crucial role in removing contaminants such as blood, dirt, and unwanted residues from poultry, pork, beef, and seafood products, ensuring compliance with stringent food safety standards. Compared with conventional manual cleaning, meat washing machines offer improved sanitation, higher throughput, and consistent cleaning quality, making them an essential component in modern meat processing facilities.

Rapid industrial automation, expansion of commercial slaughterhouses, and increasing consumption of processed meat products have further strengthened market adoption. As regulatory bodies tighten hygiene guidelines, meat manufacturers are investing in advanced washing systems to reduce contamination risks and ensure product integrity. The market continues to benefit from ongoing technological innovations, including water-saving technologies, automated chemical dosing, and sensor-based washing control systems.

Market Segmentation

The Meat Washing Machines Market is segmented into Product Type, Operation Mode, and End User.

- By Product Type, the market is categorized into Drum Type, Conveyor Type, and Batch Type.

- By Operation Mode, the market is categorized into Automatic, Semi-Automatic, and Manual.

- By End User, the market is categorized into Meat Processing Plants, Slaughterhouses, and Commercial Kitchens.

Growth Driver

One key factor driving market growth is the rising global emphasis on food safety and hygiene across the meat processing industry. Increasing incidences of foodborne illnesses have compelled manufacturers to adopt advanced cleaning technologies that minimize contamination risks. Furthermore, regulatory bodies—including USDA, FDA, and EFSA—are mandating strict sanitation protocols, pushing meat processors to integrate automated meat washing systems. These machines significantly reduce labor dependency, enhance cleaning efficiency, and ensure consistent results, thereby improving product quality and operational reliability.

Market Opportunity

A major opportunity for the market lies in the increasing integration of automation and smart technology in food processing machinery. IoT-enabled washing systems, automated water recycling units, and AI-based contamination detection tools are gaining momentum, particularly in large-scale industrial facilities. As meat processors seek more sustainable and cost-efficient operations, manufacturers of meat washing machines can capitalize on the growing demand for eco-friendly designs, energy-efficient motors, and programmable cleaning cycles. Emerging markets in Asia-Pacific, Latin America, and Africa further present strong avenues for expansion due to rising meat production and modernization of processing plants.

Meat Washing Machines Market, Segmentation

The Meat Washing Machines Market is segmented on the basis of Product Type, Operation Mode, and End User.

Product Type

The Product Type segment is further classified into Drum Type, Conveyor Type, and Batch Type. Among these, the Conveyor Type sub-segment accounted for the highest market share in 2023. Conveyor-type meat washing machines allow continuous cleaning of high-volume meat batches, making them ideal for large-scale operations. Their automated structure, reduced human intervention, and superior cleaning uniformity make them preferable in industrial slaughterhouses and meat processing facilities. These systems also enhance throughput efficiency and integrate easily with other processing machinery, contributing to their wider adoption across advanced production lines.

Operation Mode

The Operation Mode segment is further classified into Automatic, Semi-Automatic, and Manual. Among these, the Automatic sub-segment accounted for the highest market share in 2023. Automatic systems offer precision cleaning with minimal labor involvement, thereby improving hygiene and reducing operational errors. These machines often incorporate advanced features such as programmable wash cycles, temperature control, eco-friendly water usage, and sensor-based monitoring. As manufacturers shift toward full-scale automation to meet global food safety standards, automatic meat washing machines continue to dominate the market.

Some of The Leading/Active Market Players Are—

- Marel (Iceland)

• JBT Corporation (United States)

• Millard Manufacturing Corp (United States)

• Foodmate (Netherlands)

• Brower Equipment (United States)

• Mycometer (Denmark)

• Uni-Food Technic (Denmark)

• Equipamientos Cárnicos S.L. (Spain)

• Minerva Omega Group (Italy)

• BAADER Group (Germany)

• DURASYS (United States)

• Provisur Technologies (United States)

• Jarvis Products Corporation (United States)

and other active players.

Key Industry Developments

News 1:

In April 2024, a leading food processing equipment company introduced a new generation of automated meat washing systems designed to reduce water usage by up to 40%.

This innovation integrates IoT sensors and AI-based contamination detection to ensure precise cleaning cycles, offering meat processors improved sustainability and efficiency. The launch is expected to accelerate adoption in environmentally conscious markets.

News 2:

In September 2023, several European meat processing facilities announced upgrades to their production lines, incorporating high-capacity conveyor-based meat washing machines to meet new EU hygiene regulations.

These installations aim to enhance operational consistency, reduce labor dependency, and ensure compliance with updated food safety standards, driving demand for advanced washing technologies across the region.

Key Findings of the Study

- Conveyor-type machines dominated the product segment in 2023.

- Automatic operation mode led the market due to rising automation.

- Meat processing plants remained the largest end-user segment.

- Asia-Pacific is emerging as a high-growth region.

- Adoption driven by strict food safety regulations and hygiene demands.

- Live Stream

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Art

- Life

- Coding