Alternative Financing Market Growth, Segment, Analysis & Forecast Report, 2033 | UnivDatos

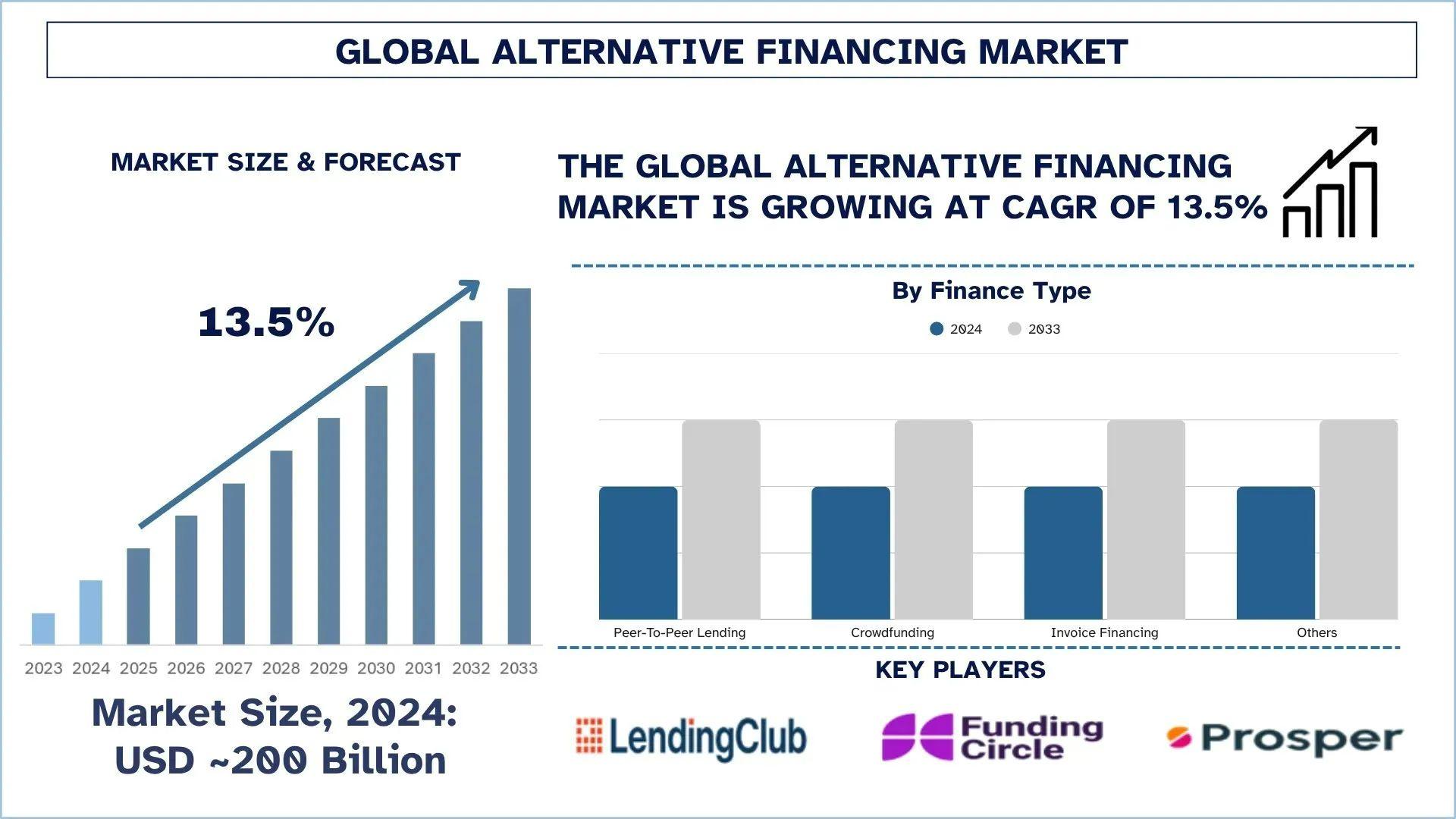

According to a new report by UnivDatos, the Alternative Financing Market is expected to reach USD billion in 2033 by growing at a CAGR of 13.5%.

The alternative financing market continues to show strong investment potential, driven by increased digital transformation and unmet credit needs. Institutional investors are increasingly viewing digital lending platforms as scalable, high-yield assets, diversifying their portfolios beyond traditional banking assets. Regulatory clarity in major economies, such as the U.S., the UK, and Singapore, is also promoting cross-border investment into compliant, tech-driven lending ecosystems. Furthermore, partnerships among private equity firms and fintech providers are driving innovation in credit modeling, liquidity management, and SME-focused financing solutions. This influx of capital and the collaborative ecosystem are expected to drive double-digit growth in the alternative financing sector over the next decade.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/alternative-financing-market?popup=report-enquiry

Increased Demand for Access to Capital

The increased demand for access to capital is one of the prominent drivers of the alternative financing market, due to changing economic conditions and evolving business needs. Small and medium enterprises (SMEs), startups, and even individual entrepreneurs are increasingly looking for faster, more flexible funding options to manage cash flow, invest in innovation, and sustain operations. Unlike traditional banks, which have strong credit requirements, lengthy approval processes, and collateral demands, leaving a significant financing gap, especially for new or digitally native businesses with limited financial history. Alternative financing platforms, like peer-to-peer lending, invoice financing, and revenue-based funding, offer faster approval processes, less paperwork, and more flexible repayment choices, attracting many consumers. For instance, Goldman Sachs', the world's preeminent investment bank, 2025 survey report revealed that 81% of small business owners who applied for a business loan or line of credit struggled to find affordable capital. As a result, 49% had to pause expansion efforts, and 41% were restricted from taking on new business. Additionally, 51% stated that, given the current interest rates, they cannot afford to take out a loan. This illustrates how the increasing demand for capital is a significant pressure point and driver, pushing firms into the alternative financing market. Therefore, businesses constrained by traditional credit barriers are increasingly turning to digital lenders and fintech-based financing platforms. As a result, the rise in demand for accessible and efficient capital sources continues to propel the expansion of the global alternative financing market.

According to the report, North America held the dominant market share in the Alternative Financing Market

North America dominates the alternative financing market due to its well-established financial infrastructure, high fintech adoption, and supportive regulatory environment. The region hosts a large number of established alternative lending platforms and peer-to-peer marketplaces that fulfill the demand of both individual and business borrowers. Strong digital connectivity, widespread use of online payment systems, and high consumer awareness have boosted the shift toward non-traditional financing solutions. Additionally, favorable government policies and regulatory clarity, especially in the U.S. and Canada, are promoting innovation and investment in digital lending and crowdfunding platforms. Furthermore, the rising adoption of technologies like AI, blockchain, and data analytics has improved credit evaluation and risk management, strengthening the region's position in the market.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis By Finance Type, By End-User, and By Region

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Related Report:-

India Personal Loan Market: Current Analysis and Forecast (2025-2033)

Micro Lending Market: Current Analysis and Forecast (2022-2028)

Asset and Wealth Management Market: Current Analysis and Forecast (2022-2028)

Asset Tokenization Market: Current Analysis and Forecast (2024-2032)

India Fintech Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- لایو استریم

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- بازیها

- Gardening

- Health

- صفحه اصلی

- Literature

- Music

- Networking

- دیگر

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Art

- Life

- Coding